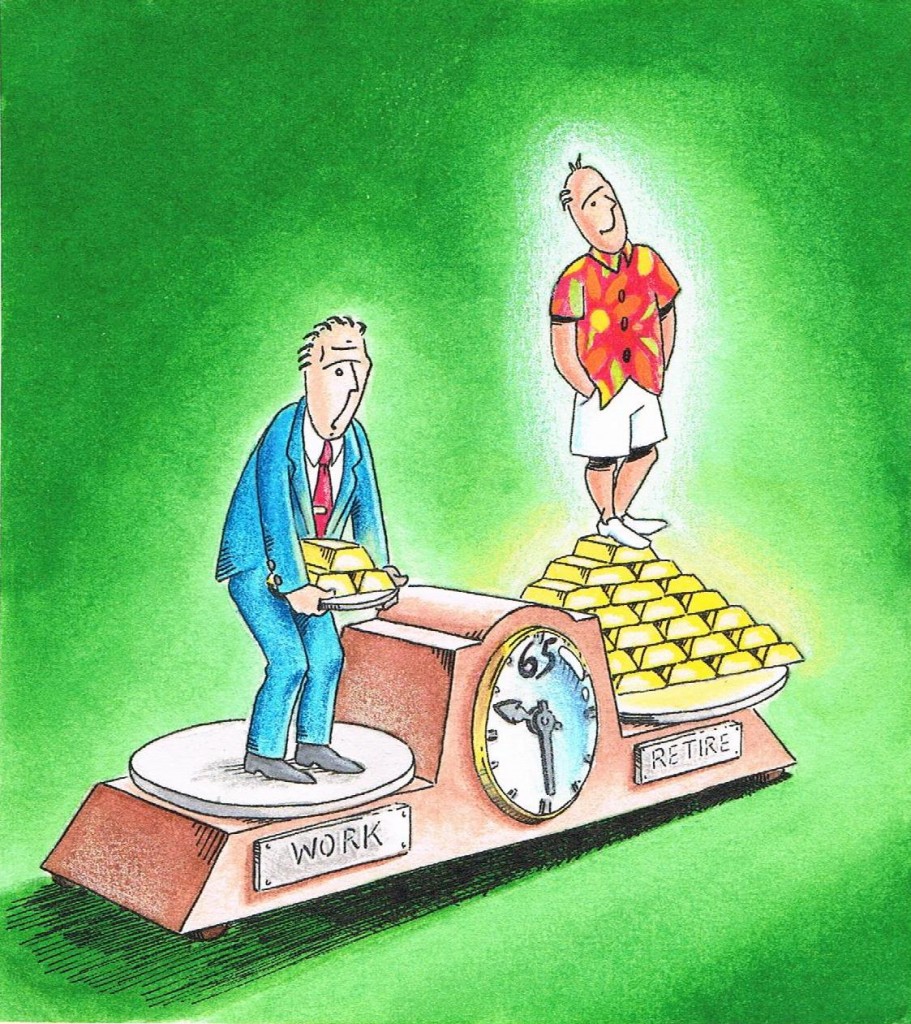

One day, your retirement income will flow from the capital you have been saving for the last thirty to forty years of your working life. Before you switch your investments to ultra-conservative vehicles such as GICs or T-bills, weigh inflation’s effect on the prospect of lowering interest on your savings against risk as you consider how close you are to retirement.

Inflation can turn low-growth to no-growth. Beware of today’s lowering interest rates. Putting all your money in safe vehicles (including GICs, T-bills, money market funds) could reduce your after-inflation retirement income. Even with an inflation rate of just 2%, an annual retirement income of $65,000 might not cover your needs over ten years. An estimated future value of $79,000 would be required to meet the same financial demands after ten years.

Growth investments may fight inflation if you are not retiring within ten years. Consider the potential to combat retirement income erosion due to inflation by holding a portion of your portfolio in diversified mutual funds that have the potential to increase in value. This strategy can also add diversification, along with professional fund management. A diversified mutual fund portfolio can increase or decrease in value, potentially gaining value when the relative stock market sectors increase. For example, a fund specializing in financial services may increase in value when the value of bank stocks within the fund increases.

Retirees and those nearing retirement should look for safe investments. Remember, if you retire at age 65, you may live another 10, 20 or 30 years. That is a significant time horizon. If you have a time horizon of ten or more years before retiring, you may be able to add growth through a diversified mutual fund portfolio. This may help fight inflation and deliver better, long-term returns in a future lower-interest-rate environment over the long term.

Important Note: Talk to your advisor about your investment risk level and the time you have left to invest before retirement. Most mutual funds can be categorized primarily as: Bond, Money Market, and Stock equity. Each category possesses distinct characteristics, risks, and potential returns that need personal evaluation by a professional